El Colombiano on the best performing BVC listed stocks: “Nutresa and Mineros Soar on the Stock Market, While Coltejer Bows Out”

The major investors behind these companies are making decisions that significantly impact the Colombian Stock Exchange.

The Colombian Stock Exchange (BVC) is experiencing a landmark week as Coltejer—once one of the country’s emblematic companies—bids farewell to the BVC, while major investors who already hold control in companies like Nutresa and Mineros aim to increase their ownership.

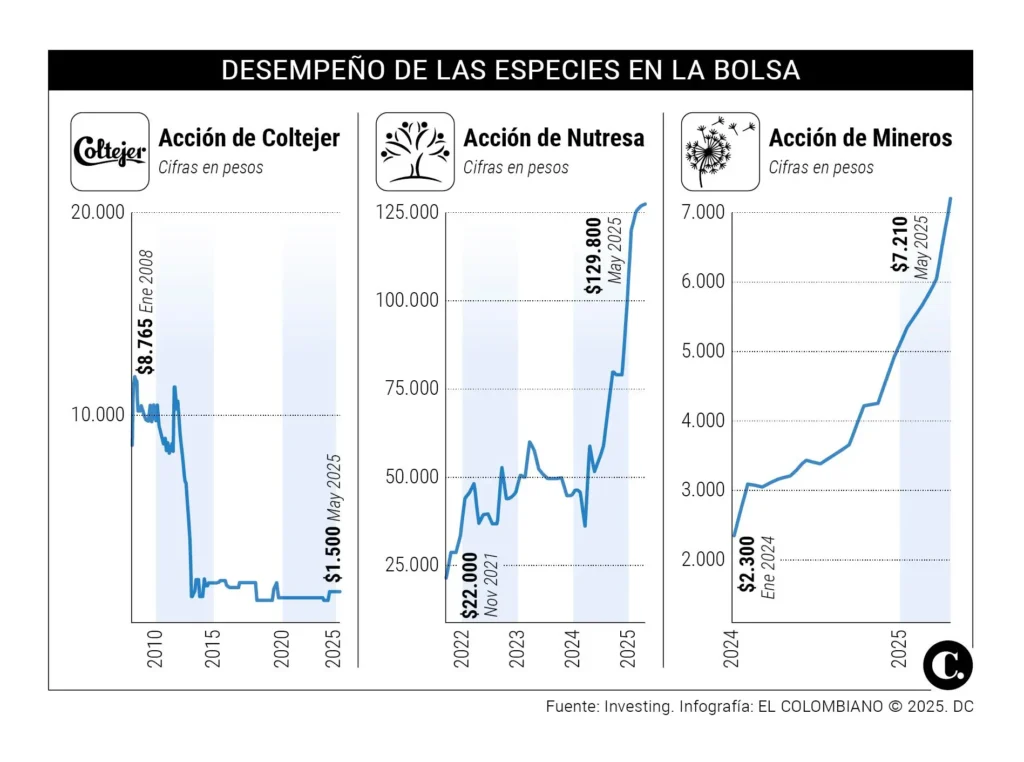

The contrast between these stocks is striking: Mineros and Nutresa are among the top performers this year on the BVC, while Coltejer’s stock sees virtually no trading, has been fixed at COP $1,500 for over 16 months, and has not been monitored by brokerage firms for years.

The experiences of the prominent business figures behind these companies also differ—some are success stories, others not.

Gilinski in Nutresa

With 84.5% of the shares in the food holding company, banker Jaime Gilinski is aiming to expand his stake this week by acquiring shares held by minority shareholders, who, according to the Financial Superintendency of Colombia, numbered over 8,000 as of December 2024.

This initiative is part of the campaign the Gilinski family launched in late 2021 to gain control of Nutresa, when it executed consecutive Public Tender Offer (PTO), including for shares in the Argos and Sura groups.

More than a year ago, after finalizing an agreement with Sura and Argos, those companies ceased to be shareholders in Nutresa. In turn, Nutresa divested from them, ending a cross-shareholding structure that had lasted over four decades.

Another significant stake in Nutresa (14.8%) is held by investors from the United Arab Emirates—Graystone Holdings and IHC Capital Holding—leaving 0.67% of the shares, about 3.06 million, in the hands of a wide array of minority shareholders.

This is the group Gilinski is targeting. Until Monday, June 9, he is offering a share buyback at COP $130,000 per share, aiming to acquire at least 600,000 shares.

For this 0.13% stake in Nutresa, Gilinski would pay COP $78 billion, and he is prepared to launch additional offers. In March, the shareholders’ assembly authorized him to repurchase up to 4.58 million shares, which would require an investment of approximately COP $595.4 billion. The message is unequivocal: Gilinski does not want minority shareholders in the company.

Since the first PTO for Nutresa shares was launched in November 2021, the stock price has increased by 497.05%, rising from COP $21,740 to COP $129,800 as of yesterday.

A second share buyback offer for Nutresa is scheduled to take place from July 1 to 7.

Coltejer Ceases Operations

Since 2008, the Mexican Kaltex Group has been the majority shareholder in textile company Coltejer. Throughout this period, the company—controlled by Rafael Kalach—reported profits only in 2010 and 2015. Following the impact of the COVID-19 pandemic in 2020, the company decided by mid-2021 to suspend operations at its plants.

Since then, Coltejer ceased fabric production and began selling its properties in Itagüí, in the southern Aburrá Valley, where its textile machinery had operated for years.

According to the Colombian Superintendent of Finance (SFC), Kalach, through companies such as Kaltex Latin America, Grupo MCM, and Kaltex América Investments, owns at least 75.7% of Coltejer’s shares—enough to approve, during a shareholder meeting last December, the delisting of the stock from both the National Registry of Securities and Issuers and the BVC.

To move forward, a delisting Public Tender Offer was successfully completed in April, allowing Grupo MCM to acquire 583,795 Coltejer shares for approximately COP $1.057 billion.

With this condition fulfilled, as of today, June 5, Coltejer’s ordinary shares are officially delisted from the Colombian Stock Exchange, where they were first issued on March 18, 1999.

Company sources recently told El Colombiano that a decision to liquidate Coltejer has not yet been made, and that potential investors are being sought to utilize the textile machinery still held at a company-owned site in Rionegro, eastern Antioquia.

Additionally, land sales in Itagüí are advancing for real estate development projects, some of which are already under construction by developers who acquired plots.

Mineros Boosted by Gold

The stock market is also closely monitoring the upcoming Public Tender Offer that Sun Valley Investments is preparing for shares in Mineros.

In April of last year, Sun Valley acquired 22.5% of the company and has since raised its stake to 57.4% through two Public Tender Offers.

With the execution of the new offer and the finalization of a direct negotiation with Corficolombiana, that stake is expected to increase to 68.4%.

While the PTO notice is published, trading of Mineros shares is currently suspended on the BVC. The last quoted price was COP $7,210, though Sun Valley’s offer sets the acquisition price at COP $5,500 per share.

So far this year, Mineros’ stock has appreciated by 69.4%, driven in part by record-high international gold prices, which have positively impacted its financial results.

Behind the acquisition and control of Mineros is Indian origin investor Vikram Sodhi, who, through Sun Valley, oversees investments focused on the metals and mining sector, with portfolio companies and offices across the Americas, Europe, and Asia.

Read the original article in El Colombiano published on June 05, 2025: Click here.