During Corficolombiana’s earnings call for the second quarter, one of the topics that came up was the sale of the stake this Grupo Aval subsidiary had in Mineros.

It is worth recalling that the firm exited its stake in the mining company during the recent Public Tender Offer (OPA) made by Sun Valley Investments, the fund of investor Vikram Sodhi.

After the sale, Sun Valley consolidated itself as the main shareholder of Mineros, holding 65.38% of the company, following multiple share purchase offers.

For Milena López, president of Corficolombiana, the sale translated into significant profits for the company, and the exit of an investment considered non-strategic for the company.

Low liquidity and focus on other sectors motivated exit from Mineros

According to López, a relevant factor is that “we had an equity stake (in Mineros) of 7.9%, which simply gave us a seat on the board, but did not give us control over the decisions made in the company.”

Additionally, she acknowledged that “with the sale of the stake we generated a profit of $40 billion,” and also said that “although at times the stock price has been above, I believe the company’s valuation depends on how I value gold, which is quite volatile.”

Another point taken into account was the low liquidity of Mineros’ shares: “A liquidity event for this stock, in the absence of a public tender offer, is very difficult. Selling an 8% stake in the market with the liquidity available would likely take almost a year to complete.”

She took the opportunity to reiterate that Corficolombiana is focusing on strategic sectors: infrastructure, energy and gas, tourism, and agribusiness — so the divestment in Mineros aligns with this company vision.

Main results of Corficolombiana as of June

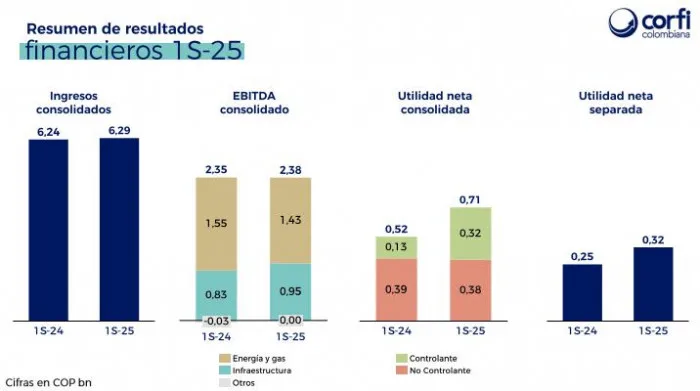

Corficolombiana highlighted that during the second quarter of 2025, it obtained consolidated revenues of $3.07 trillion, EBITDA reached $1.21 trillion, and the controlling net profit was $63.807 billion.

Meanwhile, the corporation’s consolidated assets closed at $60.6 trillion. On a separate basis, net profit for the second quarter was $61.756 billion, higher than the $23.493 billion recorded in the same period last year.

On a consolidated basis, the company closed the first half of 2025 with a controlling net profit of $324.379 billion, 140.31% higher than the same period in 2024. Separately, net profit for the first half was $318.605 billion, greater than the $245.067 billion in the first half of 2024.

Regarding strategic advances, Corfi continued the process of reducing debt and the cost of debt, as well as strengthening portfolio focus, as previously mentioned.

Read the original article in Valora Analitik published on Aug 20, 2025: Click here.