In the Central American country, there was improved processing plant performance and the prioritization of higher-grade artisanal minerals.

Mineros reported this January 7 that it achieved production exceeding expectations, which was primarily driven by its performance in Nicaragua.

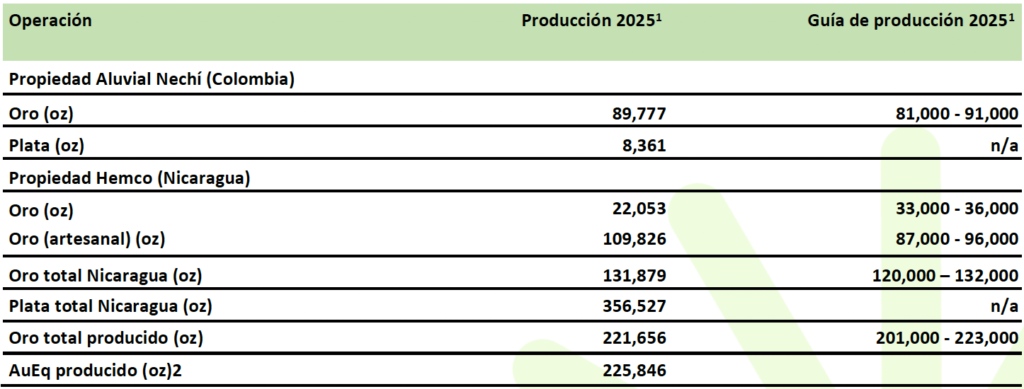

The gold mining company produced a historic figure of 20,667 ounces of gold equivalent (AuEq) in Nicaragua, and a total of 225,846 ounces of AuEq across its overall operations.

In Nicaragua, there was superior performance from the processing plant and the prioritization of higher-grade artisanal minerals, which was combined with stable production from its operations in Colombia.

“This performance begins to reflect the impact of multiple operational improvement initiatives, supported by our continuous focus on efficiency and execution. We remain confident in our ability to generate sustainable value for shareholders,” stated Daniel Henao, President of Mineros.

Specifically, Mineros revealed that at the Nechí Alluvial Property, the production of 89,777 ounces of gold reached the upper limit of estimates and was approximately 9% higher than in 2024, reflecting improved equipment availability, higher operational efficiency, and optimized production scheduling.

In the Central American country, total production of 131,879 ounces of gold surpassed projections and established a new monthly production record for the operations.

The firm clarified that ongoing initiatives are focused on systematically eliminating plant bottlenecks to increase capacity and cost efficiency.

It is important to highlight that Mineros (in addition to the operations already established in the two aforementioned countries) possesses a portfolio of development and exploration projects throughout the region, including the La Pepa Project in Chile.

Finally, the Medellin-based company anticipated that it plans to publish its financial and operational results for the fourth quarter of 2025 and the full year 2025 on Wednesday, February 18, 2026.

Read the original article in Valora Analitik published on Jan 7, 2026: Click here.