Medellín, Colombia – November 5, 2025 – Mineros S.A. (TSX:MSA, MINEROS:CB) (“Mineros” or the “Company”) today reported its financial and operational results for the three and nine months ended September 30, 2025. All dollar amounts – except per-share values – are expressed in thousands of U.S. Dollars, unless otherwise indicated. For further information, please refer to the Company’s unaudited condensed interim consolidated financial statements in dollars and the management’s discussion and analysis posted on Mineros’ website: Financial Reports and filed under its profile at www.sedarplus.com.

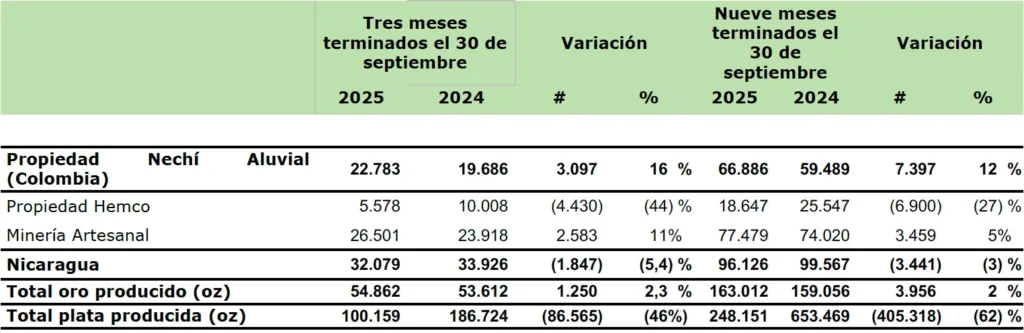

OPERATIONAL HIGHLIGHTS

Gold Production for the Third Quarter of 2025

- 54,862 ounces of gold produced.

- A 2.3% increase in gold production compared to the same period in 2024 (53,612 ounces of gold produced).

- In Colombia, alluvial production for the third quarter of 2025 was 22,783 ounces of gold, reflecting a 16% increase from the third quarter of 2024.

- Hemco (Nicaragua) produced 32,079 ounces of gold during the third quarter of 2025, similar to the 33,926 ounces produced during the third quarter of 2024.

Gold Production for the Nine Months Ended September 30, 2025

- 163,012 ounces of gold produced.

- A 2% increase in gold production compared to the nine months ended September 30, 2024 (159,056 ounces of gold produced).

Gold Production by Operating Segment

(All figures are expressed in ounces unless otherwise stated)

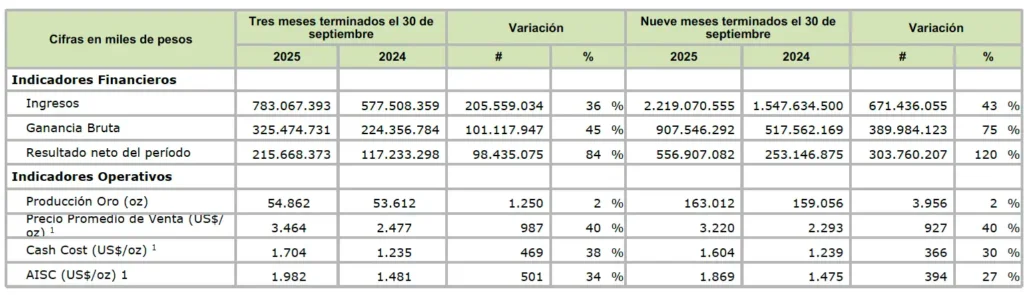

FINANCIAL AND OPERATIONAL PERFORMANCE

Below is a summary of Mineros S.A.’s financial and operational performance during the three and nine months ended September 30, 2025. Complete and detailed financial information is available in the Company’s separate and consolidated financial statements and corresponding notes for the period ended September 30, 2025.

From the Consolidated Financial Statements

(figures in thousands of Colombian pesos)

1. The Average Selling Price, Cash Cost, and All-in Sustaining Cost (AISC) indicators are not standard International Financial Reporting Standards (IFRS) ratios. These three indicators are specific to the mining industry and are expressed in U.S. dollars per ounce, as they are generally compared with the gold spot price, which is determined in the same currency. Non-IFRS measures are intended to provide additional information and should not be considered in isolation or as a substitute for performance measures prepared in accordance with IFRS. These measures have no standardized meaning prescribed by IFRS and, therefore, may not be comparable to those of other issuers. The calculation details of these indicators and additional disclosures are included later in this release. The Cash Cost and AISC indicators are specific to the mining industry and are expressed in U.S. dollars per ounce, as they are generally compared with the gold spot price, which is determined in the same unit.

Three Months Ended September 30, 2025

- Revenues increased by 36%, reaching COP $783.07 million in the third quarter of 2025, compared to COP $577.51 million in the same quarter of 2024. This increase is primarily attributed to a 40% rise in the average gold price, which increased to US$3,464/oz. Gold ounces sold amounted to 54,862 oz (2024: 53,612 oz), representing a 2.3% increase compared to the corresponding period in 2024.

- The total cost of sales increased by 30% compared to the prior-year period, primarily due to: (i) the rise in gold prices, which increased the cost of purchasing mineral from artisanal miners’ cooperatives in Nicaragua and formalized miners in Colombia by COP $77.49 million; (ii) slight increases in overall operating costs across the company’s operations, including personnel costs of COP $8.09 million, maintenance and repair costs of COP $2.23 million, and an increase in depreciation and amortization of COP $4.78 million. These increases were offset by lower service costs of COP $6.12 million and other diverse costs of COP $2.42 million.

- Gross profit increased by 45%, reaching COP $325.47 million in the third quarter of 2025 versus COP $224.36 million in the same quarter of the prior year. This is attributable to an increase in the average selling price of gold ounces and a 2.3% increase in gold production.

- Net results for the quarter increased by 159%, reaching COP $182.01 million ($0.72 per share) in the third quarter of 2025, compared to COP $117.23 million ($0.39 per share) in the third quarter of 2024. This increase is largely explained by the higher gross profit generated and increased financial income of COP $9.61$ million.

The effective Cash Cost per ounce of gold sold for the three months ended September 30, 2025, was US$1,704, and the AISC per ounce of gold sold was US$1,982, compared to an effective Cash Cost per ounce of gold sold of US$1,235 and an AISC per ounce of gold sold of US$1,481 for the same period in 2024. The 38% increase in the Cash Cost per ounce of gold sold was mainly due to higher cost of sales, driven by higher gold prices and a 2.3% increase in gold ounces sold. The 34% increase in the AISC per ounce of gold sold was primarily explained by the rise in the Cash Cost per ounce of gold sold.

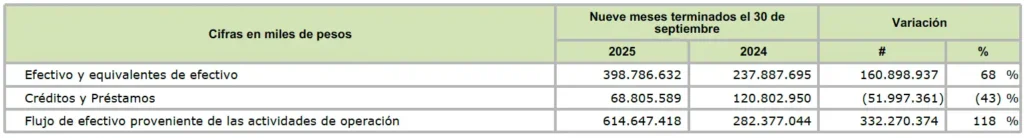

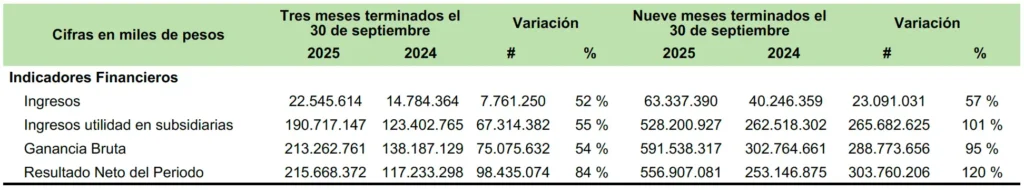

From the Separate Financial Statements

(figures in thousands of Colombian pesos)

Statement of Income

Statement of Financial Position

- Revenue increased by 54%, reaching COP$213,262,761 in the third quarter of 2025, compared to COP$138,187,129 in the third quarter of 2024. This increase was mainly driven by higher equity income from subsidiaries during 2025. Additionally, the average exchange rate rose from COP$4,004.37 as of September 2025 compared to COP$4,094.04 as of September 2024, which also contributed to the increase in revenue.

- Net income for the period rose by 84%, reaching COP$215,668,372 ($721.91 per share) in the third quarter of 2025, compared to COP$117,233,298 ($391.12 per share) in the third quarter of 2024. This result was mainly driven by higher gross profit during 2025.

- Cash and cash equivalents decreased by 81%, standing at COP$8,819,737 as of September 2025, compared to COP$47,222,217 as of September 30, 2024. The variation between periods was mainly due to the capitalization made in Mineros Chile SpA for COP$170,435,384, as well as the share repurchase for COP$47,482,620. These effects were partially offset by higher dividends received amounting to COP$165,331,930, increased commission collections and other operating income totaling COP$29,982,805, and higher cash and cash equivalents at the beginning of the period.

- Net cash flows used in operating activities decreased by 146%, reaching a negative balance of COP$2,218,655 for the nine months ended September 30, 2025, compared to COP$4,830,164 for the same period in 2024. This was mainly due to higher payments to suppliers for goods and services totaling COP$18,284,497, increased payments to employees and social security agencies amounting to COP$16,950,763, and higher payments for premiums, benefits, and other compensations of COP$1,577,562, partially offset by higher cash inflows from commissions and other income of COP$29,982,805.

CORPORATE HIGHLIGHTS

Declared Dividends

On March 31, 2025, Mineros held its Ordinary General Shareholders’ Meeting (“the Meeting”). During the session, the Meeting approved the distribution of the Company’s profits in the form of dividends. Shareholders are entitled to receive an annual ordinary dividend of US$0.10 for each common share they hold, payable in four equal quarterly installments of US$0.025 each, in advance, on May 2, August 1, November 4, 2025, and February 2, 2026.

Completion of the Share Repurchase Program

The Company completed its share repurchase program for US$12 million, which was aimed at Colombian shareholders and executed between September 1 and September 5, 2025. The Company invested US$12 million to repurchase 3,956,885 shares at a price of US$2.99 (COP$12,000) per share. The settlement date of the transaction was September 12, 2025.

Acquisition of 100% of the La Pepa Project in Chile

On September 22, 2025, Mineros completed the acquisition of Pan American Silver Corp.’s (“Pan American”) 80% interest in the La Pepa project for $40,362. Mineros now owns 100% of this advanced gold exploration project.

The La Pepa Project is a significant exploration-stage asset with a substantial estimated Mineral Resource base, located in the Maricunga Gold Belt in the Atacama Region of Chile, approximately 800 km north of Santiago and 110 km east of Copiapó, at an elevation of 4,200 meters above sea level in the Andes Mountains. The completion of this transaction marks the end of the joint venture between Mineros and Pan American and grants Mineros full control over the project’s development path.

EVENTS AFTER THE REPORTING PERIOD

Cancellation of Shares Following the Share Repurchase Program Executed in September 2025

Following the successful completion of our US$12 million share repurchase program, 3,956,885 shares were repurchased at a price of US$2.99 (COP$12,000) per share and subsequently cancelled, effective October 15, 2025. As a result, the total number of issued and outstanding shares has been reduced to 295,780,517.

GROWTH AND EXPLORATION PROJECTS UPDATES

Near-Mine Exploration, Hemco Property Expansion

Near-mine exploration is focused on the current mining operations: the Panamá Mine and the Pioneer Mine. The mineralization is associated with an epithermal gold system linked to multiple quartz veins.

A total of 7,712 meters of diamond drilling were completed across 46 holes during the third quarter of 2025, achieving approximately 90% of the 2025 drilling plan. The objective of this campaign is to increase the Mineral Resources and Mineral Reserves at the Panamá and Pioneer mines. A total of 5,172 meters were drilled at the Panamá Mine and 2,540 meters at the Pioneer Mine.

Mineros is currently updating the Mineral Resources and Mineral Reserves of the Panamá and Pioneer mines, with publication scheduled for early 2026.

Brownfield Exploration, Hemco Property Expansion

Brownfield exploration is focused on the Bonanza block, which encompasses the concession areas between the Panamá Mine and the Pioneer Mine. The mineralization belongs to the same epithermal gold trend that includes the Panamá and Pioneer mines, characterized by multiple quartz veins.

An initial drilling campaign of 17,400 meters was scheduled for 2025. Industrial deposit drilling began in July 2025 with the deployment of two additional rigs. However, due to delays in starting the program, Mineros decided to revise the total planned drilling to 8,500 meters.

During the third quarter of 2025, a total of 2,096 meters of diamond drilling were completed across 10 holes, representing approximately 25% of the revised 2025 drilling program. Drilling activities focused on two industrial deposits: Cleopatra and Orpheus.

Porvenir Project

The Porvenir Project is a development-stage project located 10.5 km southwest of the current Hemco Property facilities. The mineralization consists of a gold-zinc-silver deposit hosted in volcanic rocks, with intermediate-sulfidation epithermal quartz veins.

The Company is progressing as planned with the update of the Porvenir Project’s Mineral Resources and Mineral Reserves, aiming to maximize its value, with the optimization of the pre-feasibility study scheduled for late 2025.

Guillermina Deposit

The Guillermina Deposit is an epithermal zinc-gold-silver deposit located four kilometers west of the Pioneer deposit.

During the third quarter of 2025, a total of 2,033 meters of diamond drilling were completed across 12 drill holes, representing approximately 101% of the 2025 planned drilling program. The objective of this campaign is to upgrade Inferred Mineral Resources to the Indicated category and to obtain representative material for metallurgical testing.

Mineros plans to update the Mineral Resource estimate for the Guillermina deposit, with publication scheduled for the first half of 2026.

Leticia Deposit

The Leticia Deposit is an epithermal gold-silver-zinc deposit located 500 meters northwest of the Porvenir Project.

During the third quarter of 2025, a total of 1,396 meters of diamond drilling were completed across five drill holes, representing 107% of the 2025 planned drilling program. The objective of this campaign is to upgrade Inferred Mineral Resources to the Indicated category and to obtain representative material for metallurgical testing.

Mineros plans to update the Mineral Resource estimate for the Leticia deposit, with publication scheduled for the first half of 2026.

Luna Roja Deposit

The Luna Roja Deposit is a skarn-type gold system located 24 km southeast of Hemco’s existing facilities. The Company is focusing on expanding the current Mineral Resources and identifying new targets around the main deposit.

Mineros is advancing an update of the Mineral Resources for the Luna Roja Deposit, with publication expected in the first half of 2026.

Regional Exploration at the Hemco Property

Mineros’ regional greenfield exploration focuses on two early-stage target areas: the Rosita and Bonanza districts. The Bonanza district excludes the designated brownfield area known as the “Bonanza Block” (see Brownfield Exploration, Hemco Property Expansion).

An initial drilling campaign of 14,500 meters was originally planned for 2025, with 6,000 meters allocated to the Rosita District and 8,500 meters to the Bonanza District. Greenfield drilling began in July 2025; however, due to delays in the program’s start, Mineros decided to concentrate its greenfield regional exploration exclusively in the Bonanza District, revising the total planned drilling to 5,000 meters.

During the third quarter of 2025, a total of 3,239 meters of diamond drilling were completed across 19 holes, representing approximately 65% of the 2025 planned program. The objective of this campaign was reconnaissance drilling aimed at assessing the potential continuity of mineralization. Drilling activities comprised 2,571 meters at the Constancia-Cottam target, 538 meters at the PisPis target, and 130 meters at the Experiencia target.

Near-Mine Exploration, Nechí Alluvial Property Expansion

At the Nechí Alluvial Property, Mineros is exploring alluvial gold deposits predominantly east of the Nechí River, where the Company currently operates alluvial mining in Quaternary sediments.

In 2025, Mineros planned a 10,000-meter drilling campaign within its current operating concessions and at the Río Cauca Target, where drilling began in September.

During the third quarter, a total of 3,662 meters were completed across 142 holes, including 1,925 meters for Mineral Resource expansion, 1,677 meters of infill drilling in the current production area, and 60 meters of reconnaissance drilling at the Cauca River Target, achieving approximately 104% of the annual plan. Of this total, 637 meters in 25 holes were completed using ward (or percussion) drilling, and 3,025 meters in 117 holes were completed using sonic drilling.

La Pepa Property, Chile

The La Pepa Project is an advanced gold exploration project located in the Maricunga Gold Belt in the Atacama Region of Chile, approximately 800 km north of Santiago and 110 km east of Copiapó, at an elevation of 4,200 meters above sea level in the Andes Mountains. It is 100% owned by Minera Cavancha SpA.

The Company reassessed the potential of the La Pepa Project to support Mineros’ broader growth and diversification objectives, and on September 22, 2025, the Company acquired the remaining 80% of the mining company Cavancha SpA from Pan American for $40,362 in cash, resulting in Mineros holding 100% ownership of the La Pepa Project.

The Company is advancing plans for an exploration program scheduled to begin in 2026, aimed at evaluating and expanding La Pepa’s Mineral Resource inventory. This initiative forms part of Mineros’ long-term growth strategy to enhance resource expansion, support future reserve conversion, and unlock additional value from its current asset portfolio.

PRODUCTION AND COST ESTIMATE

Cautionary Note: The information presented herein contains forward-looking statements; such information relates to future events, including the Company’s performance, prospects, and business opportunities. Forward-looking statements may include, among others, estimates of resources and reserves, future production levels, future investment levels and allocation, as well as exploration and mine development spending. Estimated resources and reserves are based on projections of future results and internal assumptions. Any information presented that is not historical in nature may be considered forward-looking and reflects conclusions drawn based on assumptions regarding resources and reserves that may be economically viable.

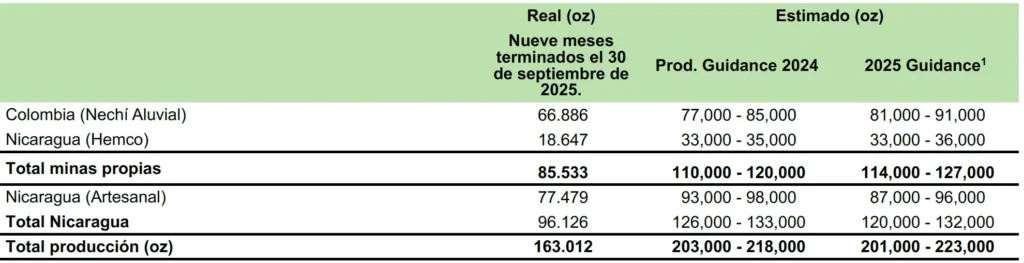

Production Estimate

Management expects gold production for 2025 to range from 201,000 to 223,000 ounces, based on the consistent performance of our underground mines in Nicaragua, our partnerships with cooperatives representing artisanal miners in Nicaragua, and improved output at the Nechí Alluvial Property.

We remain focused on operational excellence, bottleneck-elimination initiatives, and delivering strong returns to our shareholders. As gold prices rise, Mineros will continue making production decisions at its Hemco Property similar to those taken during the first nine months of 2025 to maximize gold production. This may result in a different production split between the Company’s Pioneer and Panamá mines and artisanal production compared to prior guidance.

We currently maintain our production guidance for both the Nechí Alluvial Property and the Hemco Property.

The following table summarizes the Company’s production in the third quarter of 2025 relative to the full-year 2025 estimate, which was reported to the market on January 22, 2025:

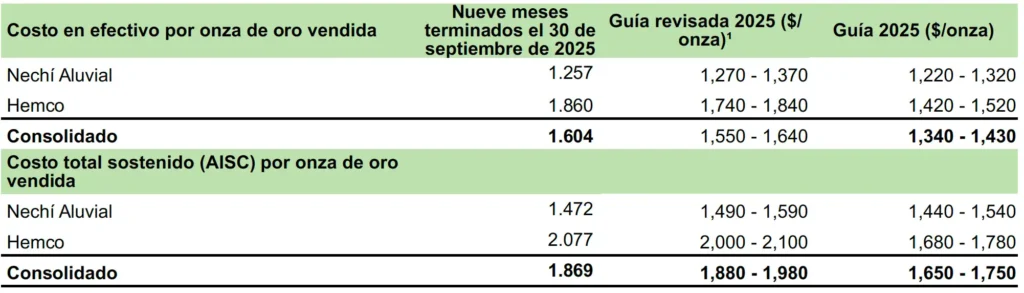

Cost Estimate

Higher gold prices are expected to result in increased Cash Costs per ounce of gold sold and AISC per ounce of gold sold at the Hemco Property, since the cooperatives representing our artisanal mining partners are paid a relatively stable percentage of the spot gold price, similar to the formalized miners in Colombia.

We maintain our guidance for Cash Cost and AISC, emphasizing that the effect of higher gold prices on the costs of acquiring additional production — both in Nicaragua, from cooperatives representing artisanal mining partners, and in Colombia, from formalized miners working with the Company — will continue to impact our Cash Cost and AISC.

The following table presents the Company’s estimated Cash Cost and AISC per ounce of gold sold for 2025, along with the actual Cash Cost and AISC for the third quarter of 2025. The cost estimate includes both material properties and ounces of gold sourced from artisanal mining (figures expressed in U.S. dollars).

Cash Cost and AISC estimates are forward-looking, non-IFRS financial measures. The 2025 guidance for Cash Cost per ounce of gold sold and AISC per ounce of gold sold has been adjusted to better reflect market consensus estimates for gold prices for the remainder of the year, which exceed US$3,000/oz, an exchange rate of COP 4,200 per USD, and 6.5% inflation. For additional information regarding the equivalent historical non-IFRS financial measures, please refer to the Company’s disclosures.

At the Nechí Alluvial Segment in Colombia, a formalization program began in 2021 through which Mineros purchases mineralized material from third parties. The model is similar to that used at the Hemco Segment, where mineralized material is purchased at a percentage discount to the spot gold price. Consequently, Cash Cost and AISC in the Nechí Alluvial Segment may increase when gold prices are higher and decrease when spot prices fall.

EARNINGS CALL AND WEBCAST DETAILS

The Company will hold a virtual conference on Thursday, November 6, 2025, at 9:00 a.m. EST (9:00 a.m. Colombia) to discuss the quarterly results. The virtual conference will be conducted in Spanish with simultaneous English translation. The virtual conference will be available at: https://app.webinar.net/9DKrB3wBmPg.

Pre-registration is required, and participants are encouraged to join approximately ten minutes before the call begins. The conference will be archived on the Company’s website at www.mineros.com.co for approximately 30 days following the event.

ABOUT MINEROS S.A.

Mineros is a Latin American gold mining company based in Medellín, Colombia. The Company has a diversified asset base, with mines in Colombia and Nicaragua and a portfolio of exploration and development projects throughout the region.

Mineros’ Board of Directors and Management have extensive experience in mining, corporate development, finance, and sustainability. Mineros has a long history of maximizing shareholder value and paying high annual dividends. For nearly 50 years, Mineros has operated with a focus on safety and sustainability across all its operations.

Mineros’ common shares are listed on the Toronto Stock Exchange under the symbol “MSA”, and on the Colombian Stock Exchange under the symbol “MINEROS”.

For more information, please contact:

Juan Camilo Obando

Director of Investor Relations

(+57) 6042665757

relacion.inversionistas@mineros.com.co

RISKS

The exploration and exploitation of precious metals involve numerous inherent risks resulting from economic conditions in the various areas of operation. As such, the Company is subject to several financial, operational, and political risks that could have a significant impact on its profitability and levels of operating cash flow. Although the Company assesses and minimizes these risks by applying high operational standards, including the careful management and planning of its operations, the hiring of qualified personnel, and the development of their skills through training and development programs, these risks cannot be eliminated.

The Company has an approved risk management methodology and policy. The methodology establishes the guidelines and criteria to identify, assess, and manage risks in accordance with the policies and objectives of the Mineros Group.

As established by the current risk management policy, the Company will focus on strategic risks—those that may affect the achievement of the corporate strategy and objectives. In this regard, these risks have been identified, closely monitored, and their progress reported in certain strategic committees.

The following describes the types of financial risk to which the Company is exposed, as well as its policies and objectives for managing these risks:

a. Credit Risk

The Company’s credit risk arises from the inability of debtors to meet their obligations or from potential losses that may occur due to the default of financial obligations by the issuers of financial instruments in which the Company has investments. The Company has adopted a policy of trading only with solvent counterparties. The Company’s credit exposures and the credit ratings of its counterparties are continuously monitored.

Regarding customers, the Company’s main debtors are evaluated annually based on their liquidity and solvency indicators. The terms established with customers for export payments are on a cash basis, and payments are made effective upon the delivery of production to the customers or refineries with which the Company works.

The Company deposits or invests its excess liquidity in first-tier financial institutions, with minimum credit ratings of A– for international investments, and for domestic investments, in issuers with ratings not lower than AA/DP1. Additionally, conservative credit policies are established, and market conditions are constantly evaluated through quantitative and qualitative risk assessments for commercial, investment, and credit operations.

The Company does not hold any collateral to cover credit risks associated with its financial assets.

b. Liquidity Risk

Liquidity risk is managed through the proper implementation of the Company’s accounts receivable and payment policies. The main objective is the efficient management of working capital and the proper optimization of treasury operations. This is administered through strict control of the budget, customer receivables, and commitments made with suppliers and stakeholders.

This management is based on the preparation and monitoring of cash flows, budgets, and projections of financial liability maturities, which are reviewed periodically to determine the treasury position required to meet liquidity needs.

c. Market Risk

Foreign Exchange Risk: The Company’s operating risks arise from gold exports, which are denominated in U.S. dollars, resulting in high exposure to exchange rate fluctuations. The Company manages this risk using financial derivatives, where the underlying asset is the exchange rate between the U.S. dollar and the Colombian peso. Derivative contracts are not entered into for speculative purposes; they are used solely to secure the exchange rate for a portion of the payments to be received in foreign currency.

The Company’s policy establishes entering into foreign exchange hedging contracts to manage the exchange rate risk associated with anticipated purchase and sale transactions, up to 50% of the generated exposure.

Interest Rate Risk: This risk is not managed due to the high cost and limited availability of financial instruments to mitigate this type of risk in the local market. The active positions of the investment portfolio are used to leverage treasury operations and therefore remain exposed to the local fixed-income market.

Gold Price Risk: The Company is exposed to gold price risk since its revenues are primarily derived from the sale of precious metals, whose prices have historically been volatile. The Company manages this risk by entering into agreements with several counterparties to mitigate price risk when management deems it a prudent decision.

In accordance with the Company’s financial risk management policy, it may hedge up to 30% of its sales volume over the next six months to manage its exposure to fluctuations in gold prices.

QUALIFIED PERSON

The scientific and technical information contained in this press release has been reviewed and approved by Luis Oliveira, Geologist, MAusIMM CP (Geo), Director of Resources and Reserves at Mineros S.A., and a Qualified Person within the meaning of National Instrument 43-101 – Standards of Disclosure for Mineral Projects.

CAUTIONARY NOTE

This press release contains “forward-looking information” within the meaning of applicable securities laws. Forward-looking information includes statements that use forward-looking terminology such as “may,” “could,” “would,” “will,” “should,” “intends,” “target,” “plans,” “expects,” “budget,” “estimate,” “forecast,” “schedule,” “anticipate,” “believes,” “continues,” “potential,” “view” or the negative or grammatical variation thereof or other variations thereof or comparable terminology. Such forward-looking information includes, but is not limited to, statements with respect to the Company’s 2025 outlook; timeline, completion, and results of a pre-feasibility study for the Porvenir Project; timeline for the completion of a Preliminary Economic Assessment (PEA) on the La Pepa Project; Mineral Reserve and Mineral Resource estimates; the Company’s planned exploration, development, and production activities; statements regarding the projected exploration and development of the Company’s growth projects, including the Porvenir Project and the La Pepa Project; timeline, completion, and results of Mineral Resources estimates and mining studies; estimates of future capital and operating costs; future financial or operating performance and condition of the Company and its business, operations, and properties; expectations regarding future currency exchange rates; and any other statements that may predict, forecast, indicate, or imply future plans, intentions, levels of activity, results, performance, or achievements.

Forward-looking information is based on management’s estimates and assumptions in light of its experience and perception of trends, current conditions, and expected developments, as well as other factors that management considers relevant and reasonable under the circumstances as of the date of this press release, including, without limitation, assumptions regarding favorable debt and equity capital markets; the ability to obtain additional capital on reasonable terms to advance the production, development, and exploration of the Company’s properties and assets; future gold and other metal prices; timing and results of exploration and drilling programs and technical and economic studies; the development of the Porvenir Project; completion of drilling programs; the accuracy of any Mineral Reserve and Mineral Resource estimates; that the geology of the Material Properties is as described in the relevant technical reports; production costs; accuracy of budgeted exploration and development costs and expenses; prices of other inputs such as fuel; future exchange and interest rates; favorable operating conditions allowing the Company to operate safely, efficiently, and effectively; political and regulatory stability; obtaining governmental, regulatory, and third-party approvals, licenses, and permits on favorable terms; renewal of existing permits on favorable terms; compliance with applicable laws; sustained labor stability; stability in financial and capital goods markets; inflation rates; availability of labor and equipment; positive relationships with local groups, including artisanal mining cooperatives in Nicaragua, and the Company’s ability to meet its obligations under agreements with such groups; and compliance with the terms and conditions of the Company’s existing loan agreements. Although the Company believes these assumptions are reasonable, they are inherently subject to significant business, social, economic, political, regulatory, competitive, and other risks and uncertainties, as well as contingencies and other factors that could cause actual actions, events, conditions, results, performance, or achievements to differ materially from those projected in the forward-looking information. Many of the assumptions are based on factors and events that are not within the Company’s control, and there is no assurance that they will prove to be correct.

For additional information regarding these and other risk factors, please refer to the “Risk Factors” section of the Company’s Annual Information Form dated March 25, 2024, available on SEDAR+ at www.sedarplus.com.

The Company cautions that the foregoing lists of assumptions and important factors are not exhaustive. Other events or circumstances could cause actual results to differ materially from those estimated or projected, whether expressed or implied, in the forward-looking information contained herein. There can be no assurance that forward-looking information will prove to be accurate, as actual results and future events could differ materially from those anticipated in such information. Accordingly, readers should not place undue reliance on forward-looking information.

The forward-looking information contained in this press release is provided as of the date hereof, and the Company disclaims any obligation to update or revise such information, whether as a result of new information, future events, or otherwise, except as required by applicable securities laws.

NON-IFRS MEASURES AND OTHER FINANCIAL MEASURES

This press release includes Cash Cost per ounce of gold sold and All-in Sustaining Cost (“AISC”) per ounce of gold sold, which are non-IFRS indicators. The Company believes that these non-IFRS indicators, in addition to conventional measures prepared in accordance with IFRS, provide investors with a better ability to evaluate the Company’s performance.

The most directly comparable IFRS measure to Cash Cost and AISC per ounce of gold sold is cost of sales. Non-IFRS financial measures and indicators are intended to provide additional information and should not be considered in isolation or as a substitute for performance measures prepared in accordance with IFRS. These indicators are not standardized financial measures under IFRS and therefore may not be comparable to similar financial indicators disclosed by other issuers. Certain additional disclosures for these non-IFRS indicators have been incorporated by reference and can be found in section “10. Non-IFRS Financial Measures” of the Management’s Discussion & Analysis of Financial Condition & Results of Operation for the three months and year ended December 31, 2024, available on SEDAR+ at www.sedarplus.com.

Read the original article in mineros.com.co published on november 5, 2025: Click here.