Over US

Billion

In precious and critical metals transactions

Over

Employees*

Globally * including mining operations

Over US

$ 1

Billion

In assets under

management

WHO WE ARE

Our extensive portfolio includes companies and branch offices situated across the Americas, Europe, and Asia. Our senior management team has several decades of combined experience in mining investing, combining exceptional investment skills across multiple asset classes with hands-on expertise in both senior and junior companies within the precious and critical metals mining and refining sectors.

SVI is committed to financing the entire precious and critical metals supply chain, including mineral exploration, mine construction, production, processing, and refining. Our holistic approach ensures that we are well positioned to meet the long-term demand for precious and critical metals by providing strategic investment capital and leveraging our deep industry knowledge to navigate the complexities of commodity cycles.

WHO WE DO IT

To meet long-term demand, we believe the metals and mining sector requires focused investment capital from knowledgeable investors who understand the unique challenges of the industry.

Sun Valley’s investment strategy focuses on sustainable development projects and operations with growth potential, low cash costs of production, and the operational flexibility to mitigate commodity market volatility.

Our team leverages advanced skills in gold mining geology and mining engineering to identify and develop high-quality assets. With a deep understanding of geological formations and engineering principles, we can accurately assess resource potential and optimize extraction methods. This expertise allows us to enhance operational efficiency, reduce costs, and maximize value.

By integrating our advanced geological and engineering knowledge into our investment strategy, we aim to achieve superior risk-adjusted returns.

By integrating advanced data analytics into our investment strategy, we aim to deliver superior risk-adjusted returns.

Invests in development, pre-feasibility and onwards, and operating stage companies or assets. Targets projects that are either near production or development-ready. These investments, ranging from $3M to $75M, are directed towards projects nearing production or construction.

We focus on early-stage exploration, project de-risking, and scoping studies. Investments in this phase range from $1M to $25M, utilizing a variety of investment structures to provide funding across the capital spectrum.

In the downstream phase, we engage in bullion sales to final clients interested in investing in physical gold, provide government-guaranteed precious and critical metals investment and storage programs, and deliver physical precious and critical metals products and investment solutions to global markets.

Our production investments range from $5M to $250M, involving both offtake finance and equity.

Through offtake finance, we provide upfront payments to partners needing capital for expansion, refinancing, acquisitions, or working capital, recovering funds via a small discount to the London FIX or SPOT at delivery.

Our equity investments offer strategic capital to mining companies, supporting growth and long-term value creation.

Gold remains a cornerstone in global financial strategies, offering stability amid economic volatility and geopolitical uncertainty. As the global economic landscape shifts, nations are increasingly diversifying their reserves, turning to gold to mitigate risks associated with reliance on traditional currencies. This shift has been driven by geopolitical events, such as economic sanctions, that underscore the necessity of secure, reliable assets. The demand for gold is expected to grow, particularly as it continues to serve as a hedge against economic instability.

In addition to its financial role, gold’s demand is particularly strong in Asia, where it plays a significant cultural and economic role. Countries like China and India, where gold is deeply embedded in both personal wealth and traditional practices, consistently drive demand. Jewelry remains a key driver of consumption in these regions, with gold seen not only as a store of value but also as a symbol of social status and wealth preservation. This ongoing demand, coupled with rising middle-class populations, solidifies gold’s position as a long-term investment and hedge against economic uncertainties.

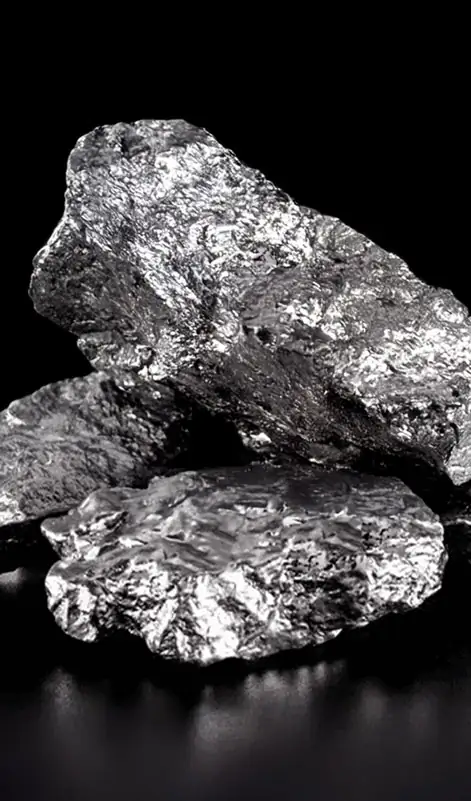

Silver plays a critical role in both industrial applications and as a strategic asset in global markets. Its unique properties make it indispensable in sectors such as electronics, solar energy, and automotive manufacturing, where it is used in the production of components like circuit boards, solar panels, and electric vehicle batteries. The growing demand for silver in these high-tech industries has placed additional pressure on its supply, which is already constrained by challenges such as declining ore grades and higher extraction costs.

While silver has historically been viewed as a store of value, its industrial demand now represents a significant portion of its overall market dynamics. Furthermore, silver’s role in the renewable energy sector, particularly in solar panel production, positions it as a critical metal in the global push for sustainable energy solutions. As industrial demand continues to grow, silver’s importance in global markets is expected to rise, emphasizing the need for secure and sustainable supply chains.

Antimony is emerging as a critical mineral due to its essential role in a variety of strategic industries, including defense, high-tech electronics, and renewable energy. Antimony is integral to the production of key technologies, such as semiconductors, solar panels, and advanced batteries, as well as in defense applications like military ammunition and nuclear weapons.

The global supply of antimony is increasingly constrained, with China, historically the dominant producer, facing challenges such as aging mines and reduced production capabilities. Consequently, the price of antimony has seen significant upward pressure, and the supply chain is at risk. The United States, which consumes approximately 50 million pounds of antimony annually, is particularly vulnerable, holding only a short-term stockpile of 6 to 8 weeks.

To address this issue, governments and industries are increasingly supporting the development of domestic antimony sources, with funding initiatives aimed at enhancing supply chain resilience.