The Advantage of Investing in Junior Gold Producers and the Lassonde Curve

Junior gold producers offer a distinct and valuable opportunity within the gold investment sector, specifically targeting investors interested in production-driven scenarios with the potential for superior returns compared to mid-tier and large mining companies. These companies specialize in the efficient extraction and initial production of gold, often capitalizing on smaller-scale projects that larger producers might overlook. Through their agile operations and strategic market positioning, junior producers not only meet gold demand but also provide competitive advantages and enhanced returns. This article explores their critical role within investment strategies, emphasizing their ability to deliver consistent, higher-than-average returns, diversify portfolios, and support innovation in production methods.

The Distinct Role of Junior Gold Mining Companies

Junior gold producers differ from mid-tier and large mining companies in several ways. While established companies often focus on large-scale operations and maximizing revenue from mature assets, junior producers excel in ramping up production from smaller, previously overlooked deposits. Their operations are typically more agile, allowing them to adapt quickly to market demands and take advantage of favorable gold price movements. Key characteristics include:

- Exploration Focus: Juniors concentrate on identifying and evaluating gold deposits, which can lead to significant stock appreciation upon discovery.

- High Sensitivity to Gold Prices: The performance of junior miners often correlates strongly with fluctuations in gold prices, making them particularly lucrative during bull markets.

- Adquisition Opportunities: Successful juniors are frequently acquired by larger mining firms, generating substantial returns for early investors.

The Lassonde Curve and Junior Gold Mining Companies

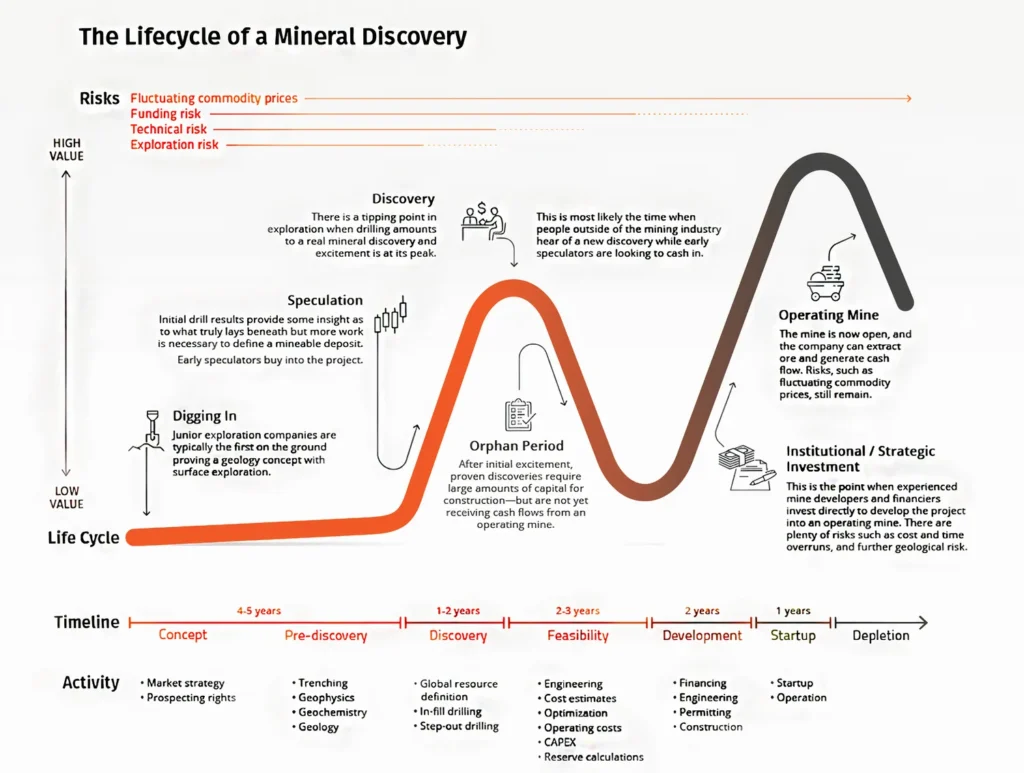

A valuable framework for understanding the lifecycle of junior gold mining companies is the Lassonde Curve. This model illustrates the phases of a mining project and the corresponding changes in valuation. The curve highlights three key stages:

- Exploration Stage: This early phase involves identifying and drilling potential deposits. Junior miners typically see a spike in valuation upon the announcement of significant discoveries. However, this stage is marked by high risk, as many exploration projects fail to deliver economic deposits.

- Development Stage: Once a deposit is deemed viable, companies focus on feasibility studies and securing permits. Valuation may dip during this period as operational risks and financing challenges take center stage.

- Production Stage: Valuations rise again as the mine enters production and generates revenue. While this phase provides stability, it is often dominated by larger producers rather than juniors.

The Lassonde Curve underscores the unique opportunities presented by junior miners in the exploration stage. Investors who enter early in this cycle can benefit significantly if the project advances successfully through subsequent phases.

Benefits of Investing in Junior Gold Mining Companies

1. High Growth Potential

Junior mining companies’ small scale and focus on exploration provide opportunities for exponential growth. A study by Gelb (2021) revealed that juniors achieving exploration success could outperform established gold producers by a wide margin. For instance, during the 2000-2010 gold bull market, junior miners’ annualized returns reached 20.5%, significantly higher than established producers’ 12.3%.

2. Leverage to Rising Gold Prices

Junior miners offer amplified exposure to gold price increases. Research by Huynh et al. (2022) demonstrates that during periods of rising gold prices, junior mining stocks often experience outsized gains compared to larger producers. This leverage is particularly advantageous in bullish markets.

3. Diversification within Gold Investments

Including junior gold mining companies in a portfolio provides diversification within the gold sector. Balancing the stability of physical gold or established producers with the growth potential of juniors allows investors to mitigate risks while enhancing returns.

4. Acquisition Premiums

Many junior miners become acquisition targets for established gold companies. Day and Beninger (2019) found that acquisition premiums often lead to significant gains for investors, particularly when juniors prove the economic viability of their deposits.

Risk Considerations

Despite their attractive potential, junior gold mining companies carry inherent risks that require careful evaluation:

- Exploration Risk: A majority of juniors fail to discover economically viable deposits, leading to financial losses.

- Financing Risk: Dependence on equity financing can dilute shareholder value, particularly during periods of low gold prices.

Investors must weigh these risks against the potential rewards, considering their own risk tolerance and portfolio objectives.

| Characteristic | Junior Gold Miners | Established Gold Producers |

| Market Capitalization | Small to Mid-Cap | Large-Cap |

| Primary Activity | Exploration | Production |

| Risk Level | High | Moderate |

| Return Potential | Very High | Moderate to High |

| Leverage to Gold Prices | High | Moderate |

| Volatility | High | Low to Moderate |

| Financial Stability | Low to Moderate | High |

Strategic Role in Asset Allocation

Junior gold mining companies can serve as a high-growth component within a diversified portfolio. By allocating a portion of their investments to juniors, investors gain exposure to the early-stage dynamics of the gold sector. Combining junior miners with physical gold and established producers balances the stability of traditional gold investments with the growth potential of juniors.

The Lassonde Curve provides a strategic framework for timing investments in juniors. By understanding where a company lies within the exploration, development, and production phases, investors can better assess risk and identify high-potential opportunities.

For instance, during the 2020-2023 period, junior miners delivered an annualized return of 23.4%, outpacing both established producers and the gold spot price. This performance underscores the value of including juniors in portfolios, especially during favorable market conditions.

Conclusion

Junior gold mining companies offer interesting opportunities for investors willing to accept higher risk in exchange for the potential of substantial returns. Their focus on exploration and early-stage development positions them uniquely within the gold investment landscape. While they come with significant risks, their potential for high growth, leverage to gold prices, and acquisition premiums make them a valuable addition to diversified portfolios.

Investors with a high-risk tolerance and a long-term perspective can benefit significantly from including junior gold mining companies in their asset allocation. By balancing these investments with more stable gold assets, such as physical gold and established producers, investors can create a robust and growth-oriented portfolio strategy.

References

- – Baur, D. G., & McDermott, T. K. (2018). Why is Gold a Safe Haven? Journal of Banking & Finance, 38(2), 438-454.

- – Day, R., & Beninger, D. (2019). The Economics of Junior Gold Mining Companies: Potential and Pitfalls. Resources Policy, 61, 214-224.

- – Gelb, A. (2021). Valuation of Junior Mining Companies: Factors Driving Success. Mineral Economics, 34(1), 77-89.

- – Huynh, T. L. D., Nasir, M. A., & Vo, A. T. (2022). The Sensitivity of Gold Mining Stocks to Gold Prices. International Review of Financial Analysis, 81, 101678.

- – World Gold Council. (2022). Gold as a Strategic Asset: A Global Perspective.

- – Lassonde, P. (2001). The Gold Book: The Complete Investment Guide to Precious Metals.