BRICS and Beyond: The Puzzle of Deglobalization in a Shifting Global Economy

At the recent BRICS summit, Vladimir Putin stated that shifting towards a multipolar world is “ongoing and irreversible.” The BRICS group has recently expanded, welcoming new members such as Iran, Egypt, Ethiopia, Saudi Arabia, the UAE, and 13 associate countries, including Algeria, Belarus, Indonesia, Nigeria, Thailand, Turkey, and Vietnam. Combined, BRICS nations now cover nearly 30% of the world’s land, 43% of the population, and 27% of global GDP.

Dilma Rousseff, President of the New Development Bank, emphasized the need for a BRICS-specific payment system. This has led to the pilot launch of “BRICS Pay,” a system using QR codes and blockchain technology to simplify transactions among member countries. China and India have also started talks to address long-standing border issues—another move toward more substantial regional unity. Together, these developments reflect BRICS’ goal of creating a more cohesive economic bloc and reducing reliance on the dollar.

The Role of Gold in a “De-dollarized” World

Historically, Gold has been a cornerstone for building stable institutions and economic integration. During the Great Depression, the U.S. held around 6,000 metric tons of gold. In 1933, President Franklin D. Roosevelt prohibited private gold ownership to increase the money supply after the Great Depression. As a result, the U.S. accumulated even more gold over the following years, and by the end of World War II, its reserves had grown to about 20,000 metric tons—75% of the world’s total gold back then. This immense gold stockpile was crucial in establishing the dollar as the world’s reserve currency at the Bretton Woods Conference in 1944, giving the dollar a level of trust and stability backed by gold.

Why Gold is Important for BRICS

Many BRICS countries have volatile currencies but strong economies with abundant commodities. By increasing their gold reserves, these countries aim to make their currencies more reliable within the bloc. Unlike U.S. treasuries, gold offers an asset universally recognized and independent of any currency.

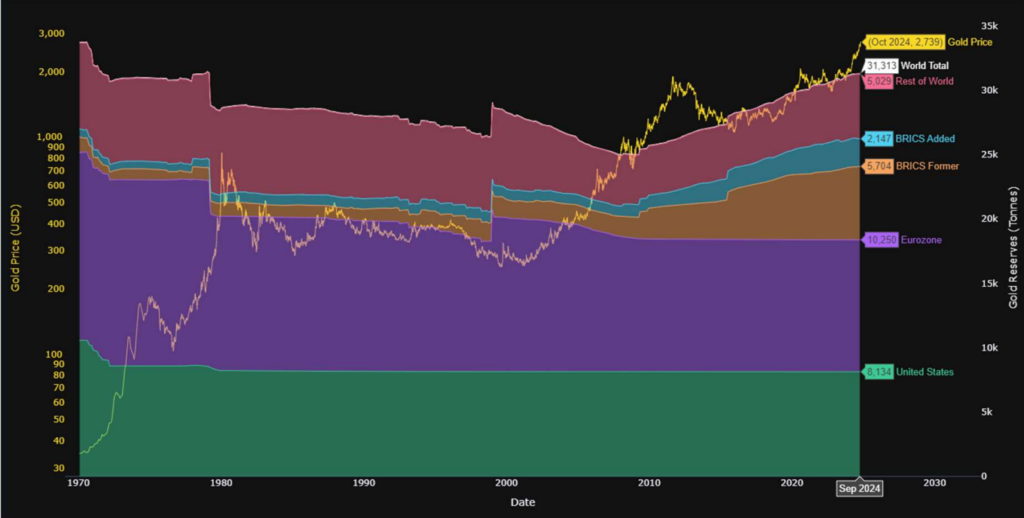

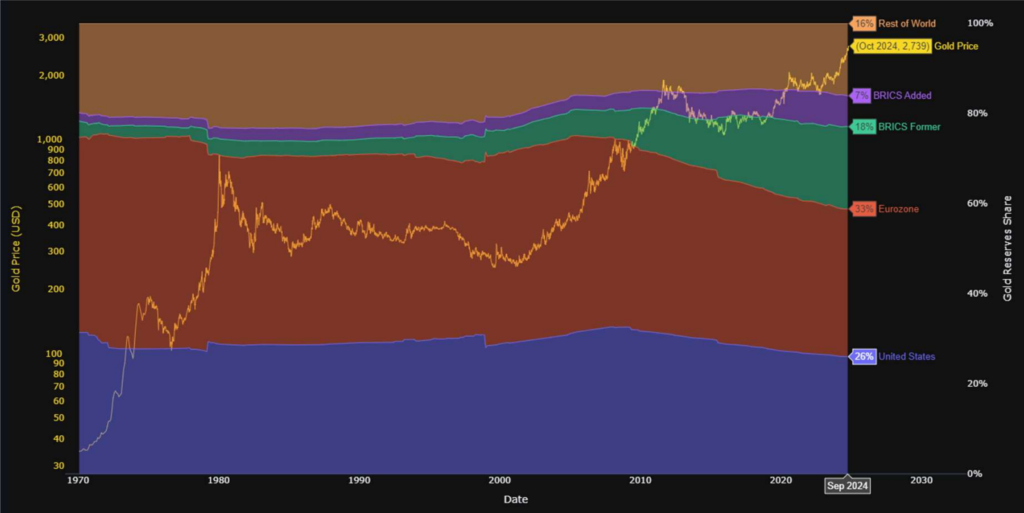

BRICS countries are rapidly growing their gold holdings, with China leading the charge over the past two years. The total BRICS gold reserves have doubled since the group’s early days, rising from 3,400 metric tons to 7,800 metric tons—just 0.3K tons below U.S. reserves and about 75% of Europe’s total reserves (Figure 1). This increase reflects the group’s efforts to create a stable financial base as they work towards a system less reliant on the dollar.

BRICS’ Growing Share of Global Gold Reserves

Since 2010, BRICS countries have grown their share of the world’s gold reserves from 13% to 25%. This increase is due to an expansion in BRICS membership and a strategic decision to increase gold holdings. Historically, the original BRICS members—Brazil, Russia, India, China, and South Africa—held around 18% of global gold reserves. Still, new additions like Saudi Arabia, Iran, and Egypt have pushed the group’s share to 25%.

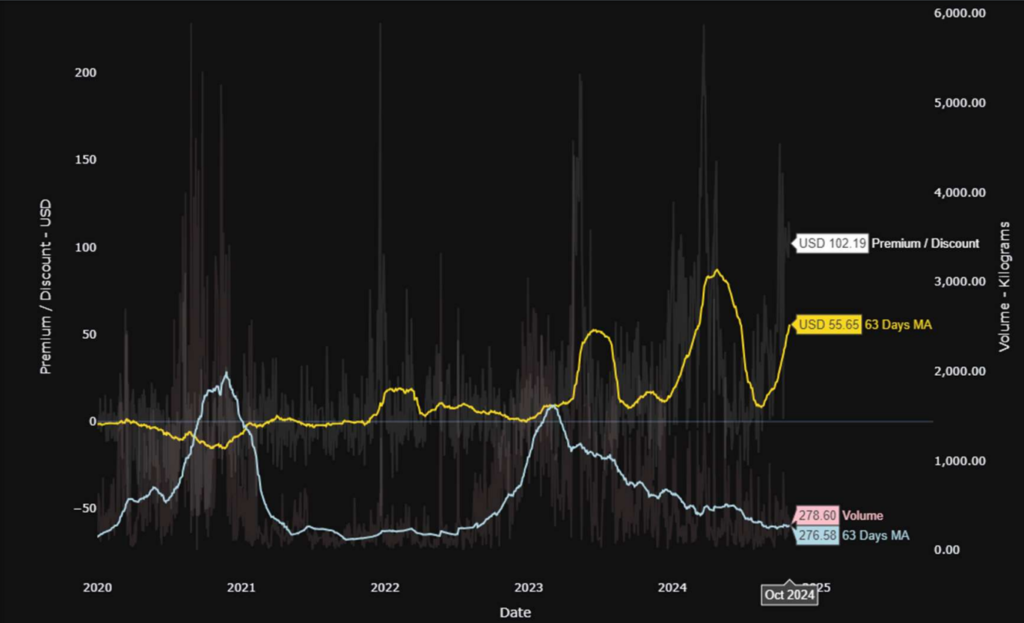

In Turkey, for example, the recent rise in gold premiums highlights an increasing interest in gold. During the third quarter of 2024, Turkey’s gold prices were around 5% higher than in Western markets (+100 USD above) despite lower trading volumes. This could indicate limited supply and increased demand for Borsa Istanbul.

This market gap shows that Borsa Istanbul has engulfed every ounce of gold it has received compared to China’s current premium (1 USD) and India’s discount (-2 USD). Given Turkey’s recent inclusion in this economic bloc, it could become a focal point for central bank

The BRICS nations are becoming a central hub for global gold trade, with their central banks actively working towards economic integration. Gold has repeatedly been shown to be the bedrock of solid financial systems, and in today’s shifting geopolitical landscape, we may be entering a new “gold phase.” Just as gold once anchored the U.S. economy and solidified the dollar’s global position, BRICS countries are now using gold to build influence and reduce dependence on the U.S. dollar. As BRICS’ gold reserves continue to grow, the bloc is positioning itself to reshape the financial world.