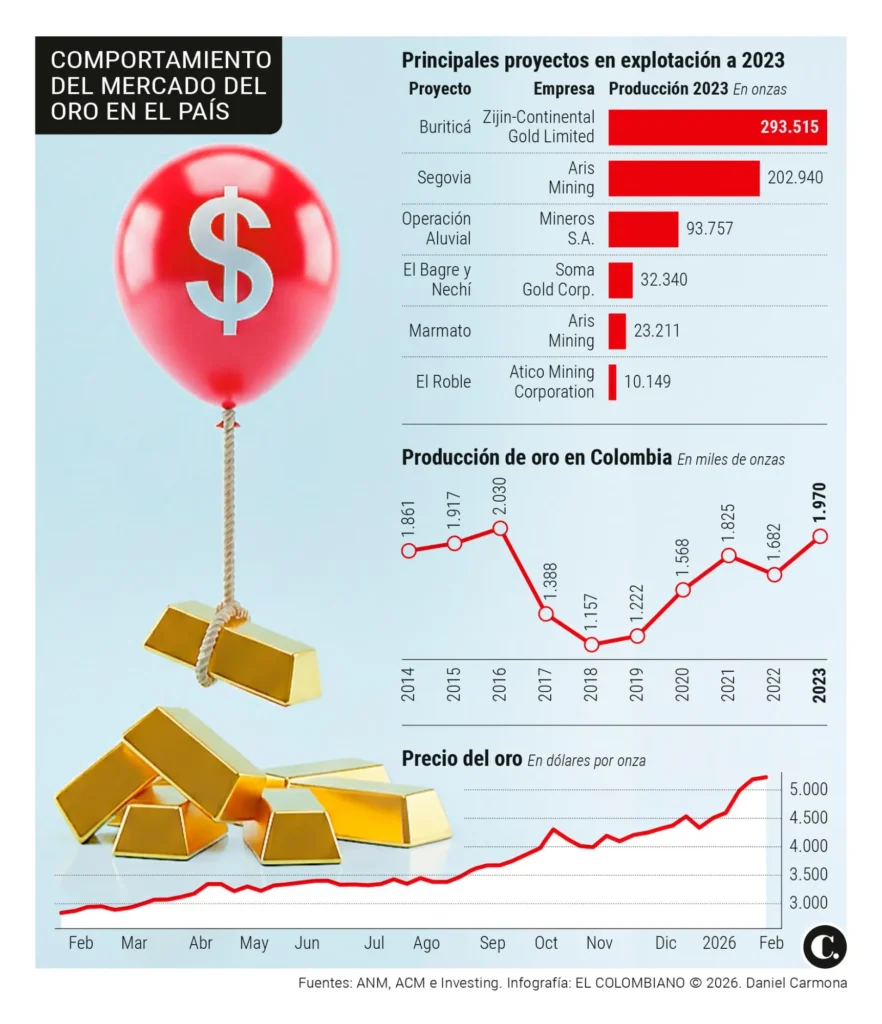

Zijin-Continental Gold, Aris Mining, and Mineros S.A. are the three main players in Colombia’s gold industry and are benefiting from record gold prices. Antioquia is the largest producer, and the precious metal accounts for more than 40% of its exports.

The global precious metals market is going through an unprecedented period that has several winners in Colombia. The price of gold broke its historic record by exceeding US$5,100 per ounce, a level that seemed unattainable just a couple of years ago.

This trend, which has accumulated an 18% increase so far in 2026, responds to a perfect storm of global uncertainty: geopolitical tensions between the United States and the European Union, tariff threats from the Donald Trump administration, and conflicts in the Middle East are pushing investors to seek refuge in gold.

In this scenario, three mining companies operating in Colombia are consolidating their positions as the big winners of the boom: Zijin-Continental Gold, Aris Mining, and Mineros S.A.. Together, these reached a production of 615,442 ounces at the close of 2024, representing nearly one-third of all legally extracted gold in the country.

Who is behind the gold companies in Colombia?

Behind these powerful operations are influential figures in the world of global business. Zijin, which operates the Buriticá mine in Antioquia, is a Chinese giant headed by Zou Laichang—who was recently appointed Chairman of the Board—one of the most prestigious executives in that country, according to Forbes China. Additionally, businessman Lin Hongfu serves as the company’s CEO. Under Zijin’s management, Buriticá has consolidated itself as the most modern underground mine in Colombia, with a production of 322,470 ounces (in 2024) and generating more than COP $1.4 trillion in taxes and royalties.

Meanwhile, Aris Mining is the second-largest player in the country. Recently, Neil Woodyer, a renowned British mining magnate, assumed the combined role of Chairman and Chief Executive Officer following the retirement of Ian Telfer. The company reported a production of 210,955 ounces in 2024, primarily from its operations in Segovia, Antioquia, in addition to the Marmato mine in the department of Caldas.

Gold has survived empires, crises, and monetary regimes.

— Sergio Cabrales (@SergioCabrales) January 27, 2026

For more than five millennia, humanity has valued this metal for its durability, scarcity, and the trust it inspires.

In 2025, the price of gold rose by nearly 40%, the largest annual increase since… pic.twitter.com/tT6cKZPQci

In statements to EL COLOMBIANO, Aris Mining highlighted that this increase in the international price benefits all players across the value chain, especially through its mining coexistence programs. According to the company, formalized small-scale miners contribute nearly 50% of its total production; therefore, the record price translates directly into higher incomes for thousands of families in mining regions.

“The increase in the price of gold should also be seen as an opportunity to advance the viability of expansion projects. This is what we are doing in Marmato with the continuous development of the Complex, including the completion of the Bulk Mining Zone, the carbon-in-pulp (CIP) plant, progress in the formalization of Cerro El Burro, and the signing of two new contracts with internal mining partners such as MyC Compañía Minera and Kabood S.A.S.,” Aris Mining emphasized.

The third major winner is Mineros, a long-standing company that now operates under the control of the firm Sun Valley Investments, led by Indian-born investor Vikram Sodhi. The company has shown positive performance not only in the mines but also in the stock market, where its share has become the top performer on the Colombian Stock Exchange (BVC) for two consecutive years.

Between January 2024 and December 2025, Mineros generated a total return of 903% measured in U.S. dollars. With a production of 82,017 ounces in Colombia (2024), plus its international operations, the firm currently trades at an enterprise value of approximately US$637 million per 100,000 ounces produced.

How much gold does Colombia export?

The impact of these operations and metal prices is reflected in national exports. Colombia currently ranks 17th in global gold production and fourth in Latin America. As of November 2025, according to data from DANE, gold established itself as the third most exported product by the country, reaching sales of US$3,886 million.

This figure is particularly revealing when compared to the US$3,548 million recorded in the same period of 2024, representing an 8.5% increase. The curious aspect of this growth is that it was driven exclusively by the value of the metal, as the volume exported in metric tons actually dropped from 62 to 50 tons in the last year.

Antioquia remains the golden heart of the country, with extraction exceeding 42 tons annually. It is followed at a distance by departments such as Chocó, Bolívar, and Córdoba, in a geological map where gold is present in almost the entire Andean and Pacific territory.

The sector’s dynamism has allowed gold to represent more than 40% of all exports from Antioquia, strengthening formal employment and infrastructure in municipalities that have historically depended on this activity. Aris Mining underlines that, in places like Segovia, social investment is directly tied to the price of the metal: the higher the price, the more resources for local education projects and civil works.

President Petro speaks on historic gold price

Despite this favorable moment for companies and the state’s accounts, the gold industry in Colombia is not free from political tensions. President Gustavo Petro took a jab, stating that Colombia would be much wealthier if the Central Bank (Banco de la República) had not abandoned gold purchases to follow foreign models that, in his words, forced the country to move to paper, the dollar, and algorithms.

Amidst the current situation, it is worth noting that official estimates indicate that more than 80% of the gold Colombia exports still comes from illegal sources, which taints the record price boom.

Read the original article in ElColombiano.com published on Jan 27, 2026: Read the article in elcolombniano.com.