Gold Prices and the U.S. Presidential Elections: A Technical Analysis of Election-Year Volatility

In the context of U.S. presidential elections, gold’s status as a “safe haven” asset often comes into focus as investors seek refuge from anticipated market turbulence. This article explores gold’s behavior during the U.S. election years, examining the impact of political uncertainty, macroeconomic policy expectations, and broader market trends on this crucial commodity.

Gold Prices in Presidential Election Years: A Historical Overview

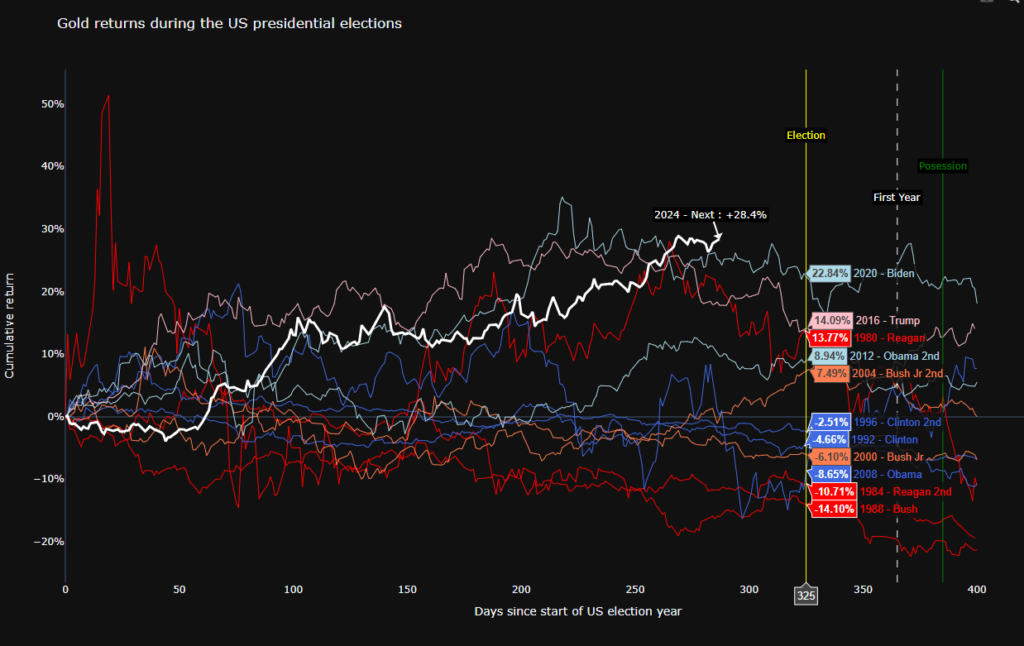

A review of election-year data from the last several decades reveals a pattern of heightened volatility in gold prices leading up to the U.S. presidential elections. Election years such as 2000, 2008, 2016, and 2020 highlight this trend. Each of these years brought unique economic and political dynamics that amplified investor uncertainty, driving notable movements in gold prices:

- 2000: Marked by the contentious Bush-Gore election, the uncertainty surrounding the recount pushed gold prices upward by around 6% in the year’s final months. The uncertainty rattled equity markets and fueled demand for gold as investors anticipated potential political fallout.

- 2008: Amid the financial crisis, the election cycle overlapped with extreme market volatility, driving gold prices up by approximately 4% by year-end. Barack Obama’s election coincided with unprecedented economic stimulus measures that underscored the appeal of gold as a hedge against inflationary expectations.

- 2016: Donald Trump’s unexpected win introduced new fears about trade policies and geopolitical relations. Following Trump’s victory, gold saw a rapid increase in volatility. Initial spikes in gold prices, reflecting immediate uncertainty, were followed by a sell-off as the dollar strengthened on expectations of pro-growth policies.

- 2020: The pandemic brought widespread economic instability and a highly polarizing election. Gold reached an all-time high of $2,067 per ounce in August as stimulus measures fueled inflation concerns. However, election-related volatility meant that gold closed the year slightly lower, reflecting investor movement to riskier assets after the election result.

Key Election-Year Drivers Influencing Gold Prices

- Uncertainty and Risk Sentiment: As a “safe haven” asset, gold often benefits from increased demand during economic or political instability. In election years, political campaigns, policy discussions, and polling results inject uncertainty into markets. The level of risk sentiment can fluctuate based on the perceived impact of the candidates’ policies, influencing gold prices accordingly.

- Market Dynamics and the Dollar: Since gold is priced in U.S. dollars, fluctuations in the dollar index (DXY) often correlate inversely with gold prices. Strong pro-growth agendas or anticipated rate hikes can boost the dollar, leading to lower gold prices, while more dovish stances or uncertain policies tend to weaken the dollar, driving up gold prices.

- Expectations of Economic Policy: The perceived economic agendas of presidential candidates influence gold’s performance by shaping expectations around inflation, fiscal stimulus, and monetary policy. For example, candidates promising aggressive fiscal expansion tend to stoke inflation fears, often boosting gold prices as a hedge against currency depreciation and inflation.

The “October Effect” and Pre-Election Volatility

Historically, the lead-up to U.S. elections sees what’s known as the “October Effect,” with October experiencing heightened volatility in equity and commodity markets. This is particularly evident in gold, reflecting investor anxieties surrounding election outcomes. Gold has seen notable price surges in October and November in several election years, only to stabilize as election results are confirmed.

Post-Election Trends: Relief Rallies or Continuations?

Once the election results are confirmed, gold often experiences a “relief rally” if political clarity is achieved, or it may undergo a corrective phase as investors recalibrate their positions based on anticipated policy directions. For instance, in 2016, following Trump’s

election, gold initially rose before facing a downward trend as markets adjusted to anticipated deregulation and tax cuts.

In sum, U.S. presidential election years tend to bring a mix of volatility and short-term price surges in gold, primarily driven by uncertainty and policy expectations. While the correlation is not absolute, gold prices in election years often serve as a barometer for political sentiment, economic policy outlook, and market risk. Understanding these dynamics is crucial for investors to navigate the uncertainty associated with election years and align portfolios to mitigate related risks.