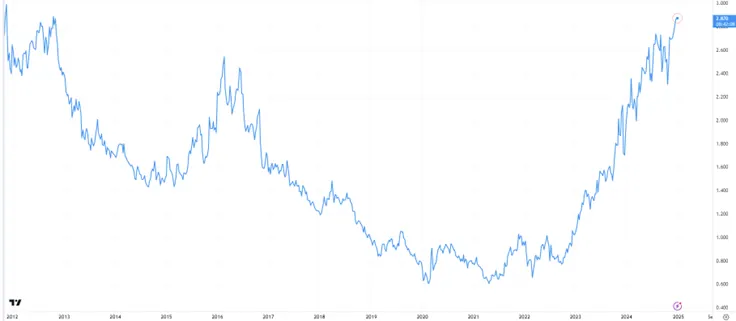

Precious metals performance since 2012:

In commodities trading, precious metals have always been indicators of economic health, monetary policy, and technological change. Gold has traditionally been the go-to safe-haven asset, but palladium’s impressive rise over the last decade brought a new dynamic to the market. Now, the tide seems to be turning, with palladium losing steam and gold regaining its lead.

The Performance of Palladium: From Bull Market to Turbulence

Palladium enjoyed a spectacular bull run for much of the 2010s and early 2020s, primarily driven by its essential role in automotive catalytic converters. However, the landscape began to shift in 2022 and 2023 as advancements in electric vehicle (EV) technology started to disrupt the market. Unlike traditional gasoline engines that rely heavily on palladium for emission control, EVs bypass this requirement entirely. This technological shift places palladium in a similar predicament as crude oil: both are being gradually edged out by cleaner, renewable, and more sustainable technologies. This trend has significantly dampened the once-bullish outlook on palladium.

The Changing Sentiment: Gold vs. Palladium

Gold, on the other hand, has regained its allure as an essential safe-haven asset. In the face of global economic uncertainties, gold has always been a go-to for central banks and investors looking to hedge against inflation, currency devaluation, and geopolitical strife. While palladium’s future is closely tied to industrial demand and technological trends, gold’s status remains more firmly entrenched in financial security and wealth preservation.

Gold-Palladium Ratio:

Reaching a peak signals either Palladium recovery or Gold loosing strength.

Beijing’s Deflationary Forces: A Gold Tailwind, a Palladium Headwind

One of the most significant influences on the precious metals market has been China’s economic policy. As the biggest consumer of commodities, any change in Beijing’s strategy affects markets worldwide. Lately, China’s economy has been slowing down, with deflation adding pressure and affecting global supply chains and commodity prices.

For gold, these deflationary forces have been a tailwind. Deflation often leads to lower interest rates and increased demand for stable assets as investors seek refuge from economic uncertainty. Central banks, notably in emerging markets and even some in advanced economies, have been buying gold as a strategic asset to diversify their reserves and guard against currency risk. This trend underscores gold’s renewed position as a preferred store of value.

Conversely, palladium faces significant headwinds from these same deflationary pressures. Reduced industrial demand from China, a key player in the automotive market, has strained palladium prices. Additionally, the country’s push toward greener technologies and EVs means that the future of internal combustion engines—and by extension, palladium—is uncertain.

What about silver? Let’s look on Banks’ Preferences.

Central banks have made one thing clear: they’re focusing on buying gold, not silver. This shift is important for market watchers. While silver has its uses in industry and as an investment, it doesn’t hold the same strategic value as gold for these institutions. The move toward gold highlights a bigger picture—protecting national wealth during times of uncertain monetary policy, possible geopolitical tensions, and changing global trade dynamics.

Gold-Silver Ratio:

Could Gold Face a Significant Correction Like Palladium’s Bull Market Crash?

While gold could experience price corrections or fluctuations due to market dynamics, it is unlikely to replicate palladium’s trajectory due to its broad-based demand, role as a financial asset, and strategic importance to central banks. Gold’s enduring role as a hedge against economic uncertainty ensures that, even after periods of euphoria, it maintains value differently than palladium. Thus, while gold may face cyclical downturns, it is unlikely to see a decline driven by technological shifts or industry changes in the way palladium has.